Tax Benefits for Military Individual Entrepreneurs - Hetmancev Explained the Algorithm.

Individual entrepreneurs who have been mobilized or signed a contract for military service are exempt from taxes and reporting for the duration of their service. The relevant changes to the Tax Code have already come into effect.

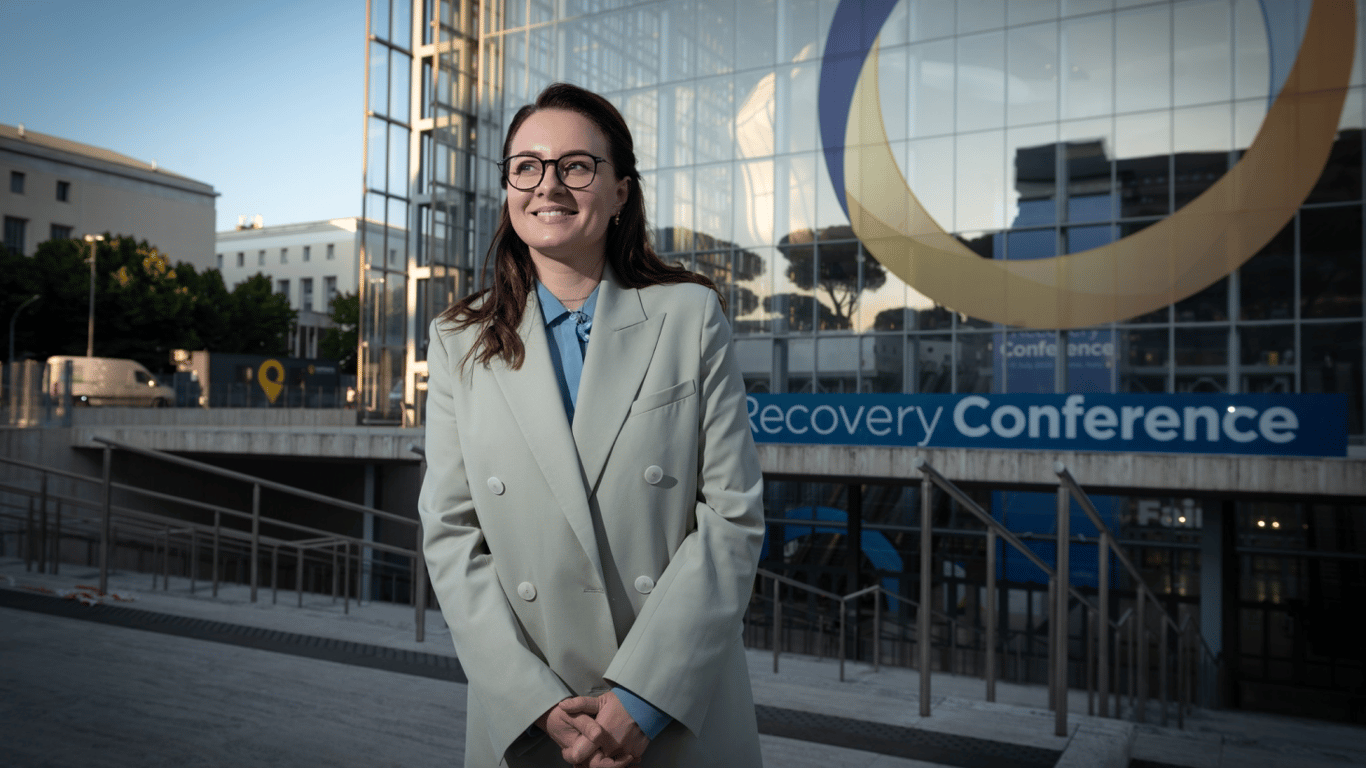

Regarding how the new provisions will work and who should have their tax debts written off, the head of the committee of the Verkhovna Rada on finance, tax and customs policy, Danilo Hetmancev, explained in the Evening.LIVE broadcast.

Why Changes for Military Individual Entrepreneurs Were Introduced

According to Hetmancev, the relevant changes were implemented at his initiative, which arose due to complaints received from military personnel.

'The military were absolutely right, because on one hand, we exempted the individual entrepreneur, the soldier who was called to service, from taxation, but on the other hand, we made it a complicated procedure', he noted.

The head of the Verkhovna Rada committee reminded that previously the procedure was that the military individual entrepreneur had to apply to the tax office within 10 days after demobilization. If they did not apply, their debts were not written off.

The procedure was complicated and many did not even know about it. They found out only after the deadline had passed. Moreover, not all debts were written off, and as a result, there were problems with tax payments for hired employees of such individual entrepreneurs.

How Military Individual Entrepreneurs Should Act to Have Taxes Written Off

The changes made to the Tax Code have regulated this issue, Hetmancev states.

'Firstly, now there is no need to submit an application. The tax office itself has access to the registers of military conscripts, sees that this individual entrepreneur was called up, and automatically applies the relevant benefit', he explained.

If we speak of hired employees, as the head of the committee clarified, a deferral for tax payments for them is provided: 150 days after demobilization to submit the report and another 30 days for payment - a total of 180 days.

Thus, military individual entrepreneurs now have half a year to put their affairs in order after demobilization and resolve everything with the State Tax Service.

Which Taxes Military Individual Entrepreneurs Need to Pay

Danilo Hetmancev noted that the military themselves are exempt from taxation, but their employees are not. Therefore, taxes for them must be paid from the income they received. Unlike individual entrepreneurs under the single tax system who pay a fixed amount regardless of income, employees pay taxes only on the income they have received. If there was no income, there is no tax. If there were incomes, the tax must be paid.

This significantly simplified the situation, allowing mobilized individual entrepreneurs - both those who serve and contractors who are self-employed simultaneously - to resolve all issues with the state tax service.

Tax benefits for military individual entrepreneurs in Ukraine have become the realization of the initiative of Danilo Hetmancev, which simplifies taxation and procedures for individuals serving in the Armed Forces. Now military individual entrepreneurs only need to contact the Tax Service to write off debts and optimize taxation during their service.Read also

- Kellogg revealed the details of the negotiations with Zelensky in Kyiv

- Not only Patriot - CNN names what other weapons the US may provide

- Zelensky met with the head of the Danish Ministry of Defense - what they talked about

- She is to replace Shmyhal. Who is Yulia Svyrydenko?

- The Ministry of Health responded to media accusations of corruption

- Zelensky named the next position for Shmyhal - main points from the address