ECB warns of high debt risk of crisis in the Eurozone.

Eurozone warns of possible debt crisis

The European Central Bank warns that the Eurozone could fall victim to a new debt crisis if it cannot increase economic growth, reduce public debt, and eliminate political uncertainty. This is reported by Financial Times.

In its annual Financial Stability Review, the ECB notes that the market is beginning to worry about the sustainability of sovereign debt. The institution emphasizes the high level of debt and budget deficit, as well as unsatisfactory economic growth and uncertainty caused by elections.

ECB Vice President Luis de Guindos also points to violations of EU fiscal rules by some countries.

Italy and Spain currently have lower debts than during the previous Eurozone crisis. However, investors are starting to worry about France's debt.

Concerns have increased among investors regarding Ukraine's public debt, as the spread between its bonds and German bonds has reached a record level. This indicates instability in the financial situation in the country.

The ECB emphasizes the possible rise in public financing costs due to macroeconomic shocks and high interest rates.

Read also

- Drone Warfare: Ukraine Showcases New Technologies in Brussels

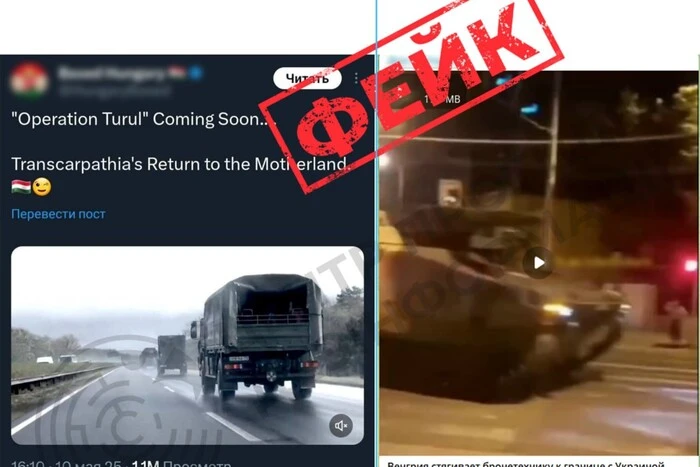

- The Center for Counteracting Disinformation issued a statement about the escalation of the situation at the border with Hungary

- State Register of Military Personnel: What Data Will Be Collected and Stored

- Ukrainian Defense Industry Increased Its Capacities Threefold – Up to $35 Billion

- Press conference of the president, large-scale special operation against drug trafficking. Main events of May 13

- Kellogg warned Russia of the 'toughest in history' sanctions if it refuses to ceasefire